New York Construction Report staff writer

Worker shortages are affecting nearly all construction firms across the country, undermining the industry’s ability to complete projects on time and on schedule and threatening the success of new federal investments in infrastructure and manufacturing, according to the results of a workforce survey conducted by the Associated General Contractors (AGC) of America and Autodesk.

In New York, 100% of contractors responding to the survey said they currently have open positions and difficulty hiring bricklayers, carpenters, cement masons, heavy equipment operators, mechanics, general labor and other positions.

Also, 73% of respondents said the most common reason for hiring challenges is “available candidates are not qualified.to work in the industry” and 45% said potential employees “report needing flexible work schedules/option for remote work.”

Results underscore how public officials have a vested interest in investing in new construction-focused workforce development programs.

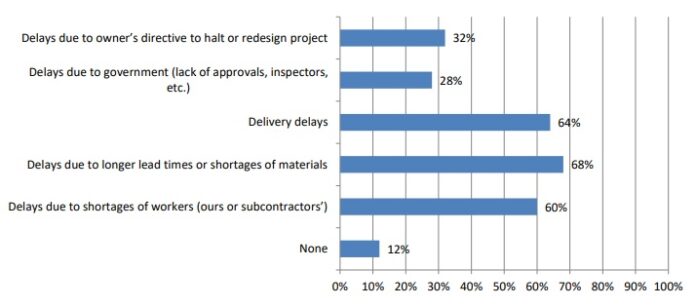

“Construction workforce shortages are severe and having a significant impact on construction firms of all types, all sizes and all labor arrangements” said Ken Simonson, the association’s chief economist. “These workforce shortages are compounding the challenges firms are having with supply chain disruptions that are inflating the cost of construction materials and making delivery schedules and product availability uncertain.”

Also, 78% reported delays due to longer lead times or shortages of materials and 56% said projects have been delayed due to worker shortages, including subcontractors.

To address the labor shortage, 72% of New York construction companies answering the survey said they have increased base pay rates and 40% said they are offering incentives or bonuses to attract employees.

Construction employment jumped in 31 states in August, according to federal employment data released by the Associated General Contractors of America.

Illinois added 3,500 jobs, up 1.5 percent and second to Arizona (5,300 jobs, 2.9 percent). Georgia was close behind, adding 3,300 jobs (+1.6 percent) and the largest percentage gain was in Arizona, followed by Kentucky and Utah.

The gains come even as a majority of contractors report they would have hired more workers if they could find them, according to a survey the association released at the end of August, urging government officials to invest in new construction-focused education and training programs to get more people into the industry.

“Despite an overall rise in construction employment, too many openings remained unfilled due to a lack of qualified workers,” said Ken Simonson, the association’s chief economist. “As a result, many projects are being delayed or even canceled.”

The 2022 workforce survey completed in August, found 93 percent of respondents had openings for hourly craft workers. The most common reason for difficulty in filling positions, cited by 77 percent of firms, was that available candidates were not qualified to work in the industry. Two-thirds of firms reported that projects had been delayed due to shortages of employees or subcontractors.

Officials said they expect demand to increase for a variety of construction categories, particularly for infrastructure, manufacturing plants, and power and energy projects, thanks in part to new federal investments in those sectors. They warned that projects will face increasing delays and become more expensive unless the pool of workers expands.

“New federal investments in construction training and education programs would help get more people into high-paying construction careers,” said Sandherr, the association’s chief executive officer. “Getting more people into construction will expand the middle class while also making it easier to modernize the economy.”

Minnesota lost the most construction jobs in August (-1,900 jobs, -1.4 percent), followed by California (-1,700 jobs, -0.2 percent) and Missouri (-1,400 jobs, -1.0 percent). Wyoming had the largest percentage loss (-3.2 percent, -700 jobs), followed by Mississippi (-2.7 percent, -1,300 jobs) and Montana (-1.5 percent, -500 jobs).